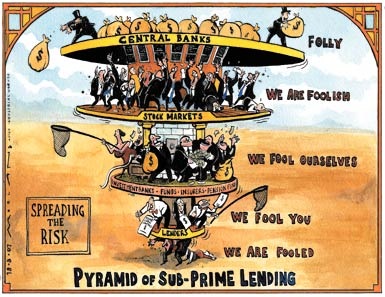

the follies of the dotcom valuations and the subprime loans, that would really interest us because they were a ripoff.To take just one example. A couple secured a loan for $1.5m (with no collateral whatsoever), bought a house for $1.16m, refurnished it for $333,000, lived happily in it for three years and then coolly walked off! Nobel laureate Paul Krugman’s “After the Money’s Gone” tells it all.

You can use any cliché to describe the Panic and its aftermath: lax lending, the lure of cheap money, greed or whatever. But the one that is really spot on about business specialists is Saul Bellow’s remark that “a great deal of intelligence can be invested in ignorance when the need for illusion is deep.” (via V V: How bubbles burst).

I swear I will throw up ... if one more book on these bubbles is written ...

The cause for these entire financial crises was too many dollars being printed by the US to buy products and services from poorer economies (like China) with pieces of paper. That is the root of the problem. We dont need a book to tell us this.

The review is better than the book. Especially the closing lines by Saul Bellow (given above).

No comments:

Post a Comment