On January 9, Standard & Poor’s announced that Greece, Spain and Ireland were on review for a possible downgrade, indicating that a Eurozone country could default. If financial crises have taught us one thing, it is to take such “black swan possibilities” (as Nicholas Nassim Taleb would describe it) seriously. A sovereign default by a small country could wreak havoc on the markets for credit default swaps (CDS) and might even destroy financial institutions in other Eurozone countries. It could trigger panic rise in bond yields and the threat of contagion could turn into a self-fulfilling prophecy. A far more serious threat would be a cascading series of defaults that would eventually include one or more of the Eurozone’s large countries. The 10th birthday of Eurozone seems to be holding out ominous portents. (via Sunil Kewalramani: Will 2009 be the year of sovereign defaults?).

For the last 50 years, under the garb of macro-economic aggregates, total Government finances were seen as proxy for a nation’s economic health. And that assumption, based on faith rather than logic has been been inverted in the last 20 years.

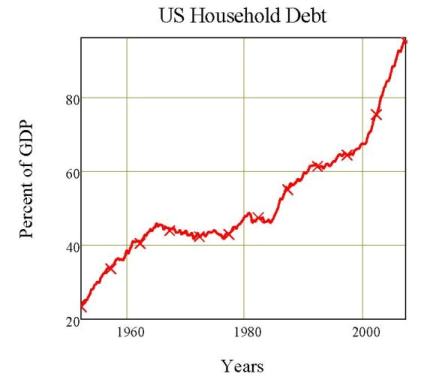

While country and Governmental finances were analysed to within a hair’s breadth away from death, private debt and aggregates of private debt were given a cursory analysis.

As the ‘demand side’ economics crash-landed into the stagflation of the 70s , it gave way to ‘supply side’ economics. With increasing supplies, consumers needed money to buy the supply.

Welfare statism became unfashionable - and the Petro-Dollar alternative became available. Shortly, after Petro-Dollars, a new source of enthusiastic cheap funding became available - China. With Petro-Dollars and China competing for Western favor, a mountain of debt was within a realm of possibility.

Welfare statism became unfashionable - and the Petro-Dollar alternative became available. Shortly, after Petro-Dollars, a new source of enthusiastic cheap funding became available - China. With Petro-Dollars and China competing for Western favor, a mountain of debt was within a realm of possibility.

With the arrival of ‘frothy Alan’ and ‘helicopter Ben’ and the ‘ménage à quatre’ was soon complete. The dollar hegemony allowed this build up of debt - and while China is acting as the injured party, it is time someone informed them of the Western concept of ‘caveat emptor’.

The more worrisome aspect is the desire to fall into Western arms - by many ‘developing’ economies, all over again. And leading the default league tables are the US and Britain.

The more worrisome aspect is the desire to fall into Western arms - by many ‘developing’ economies, all over again. And leading the default league tables are the US and Britain.

The illustration of bathos! Indian policy-bureaucracy complex looking Westward for inspiration.

No comments:

Post a Comment