All this puts the SEC and the rest of the government in a horrible spot. It is a matter of public record that the law wasn’t followed, thanks to Cuomo’s disclosures last week. And yet the agencies and policy makers responsible for enforcing the law are probably powerless to do anything about it.It would be nice to think that SEC Chairman Mary Schapiro might call for a sincere, thorough investigation. But there’s nothing in her professional background that suggests she has the spine or the nerve to take on a major financial institution, much less a former Treasury secretary or the sitting Fed chairman.

We probably won’t get any searching inquiries out of the banking industry’s elected overseers in Congress. Senate Banking Committee Chairman Christopher Dodd took VIP loans from Countrywide Financial Corp, now a subsidiary of BofA. His counterpart in the House, Barney Frank, declared last July that Fannie Mae and Freddie Mac were “not in danger of going under,” about two months before they did.

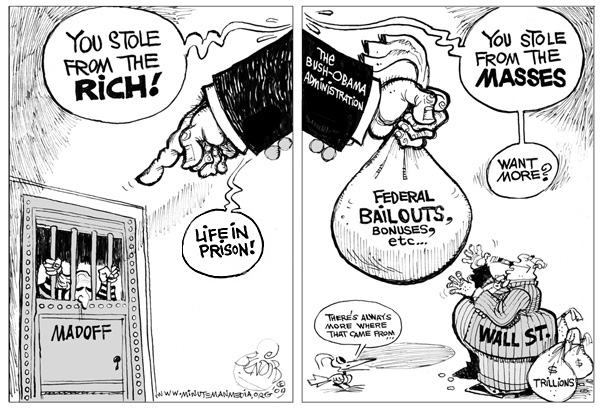

That leaves you and me, the American public, with the uncomfortable realisation that we are slipping toward a state of lawlessness in this country, all in the name of saving our financial system by creating even bigger banks out of combinations of banks that were dangerously big already. This doesn’t inspire confidence. It destroys it. (via A nation under banks, with justice for none).

Fraud .. when people are in pain ...?

This is very similar to Joseph Kennedy’s shorting the market before The Great Depression. It has always been a wonder to me how could Joseph Kennedy, a bootlegger and a friend of the mafiosi could become SEC Chairman? And after that did happen, would a Great Depression not follow?

First, the world was hit by Big Oil and as though that was not enough, came the Big Banks!

Hank Paulson Should be investigated

It was always 2ndlook’s suspicion that Hank Paulson’s behaviour in the Lehman collapse is similar to Bootlegger Kennedy’s behaviour. And this now coming out all in the open!! JPMorgan was blamed for Lehman collapse. This was reported widely including in The Times of India.

US bank JPMorgan Chase stands accused of precipitating the collapse of American investment bank Lehman Brothers by freezing Lehman assets days before it filed for bankruptcy protection, the Sunday Times reported.

After 60 Days

While deciding on Bear Stearns, Lehman Brothers, WaMu, was Paulson looking at his future - 60 days later, when he would need a new job!

Was the collapse of Lehman a deal for a job with Goldman - or was it JP Chase? JPMorgan Chief Had Long drooled Over WaMu. While a lot of people were getting support, Paulson allowed Lehman to go under!

I wonder why?

Was he making it easier for his ex-employer Goldman? Is he helping out the JP Morgan – with WaMu and Bear Stearns?

Does Transparency International call this corruption - or is it par for the course?

No comments:

Post a Comment