- Multiple currency options

Currency specialist Avinash Persaud, a member of the panel of experts, told a Reuters Funds Summit in Luxembourg that the proposal was to create something like the old Ecu, or European currency unit, that was a hard-traded, weighted basket.

Persaud, chairman of consultants Intelligence Capital and a former currency chief at JPMorgan, said the recommendation would be one of a number delivered to the United Nations on March 25 by the U.N. Commission of Experts on International Financial Reform.

"It is a good moment to move to a shared reserve currency," he said. (via U.N says world should ditch dollar - International Business Times).

What Has Been India Upto?

While the US has been resisting calls for action, busy doing post-mortem, Asia and Europe have been moving. Interestingly, Manmohan Singh has done some huge work in a crucial 60 days - the nuclear deal with the USA and NSG, the IBSA Summit, the ASEAN free trade agreement and his three Asian nation visits. India’s Trade and Commerce Minister, Kamal Nath, has been talking about a multi-lateral set up. The UN was made to issue a statement on this. Am I reading too much into this? At times, India has seemed clueless.

Avinash Persaud, ex-JP Morgan, at the UN panel of specialists was a master stroke. Mainline media has ignored this development.The 2ndlook proposal, on November 8th, 2008, for the Third Global Reserve Currency, named BRIX, based on first appearances, has a superstrate layer over the UN panel's proposal.

Though, I do wonder what the ex-IMF expert is doing? Will India take a leadership role?

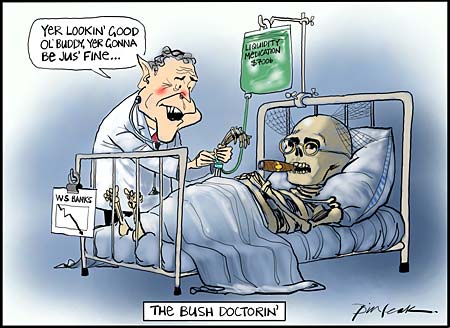

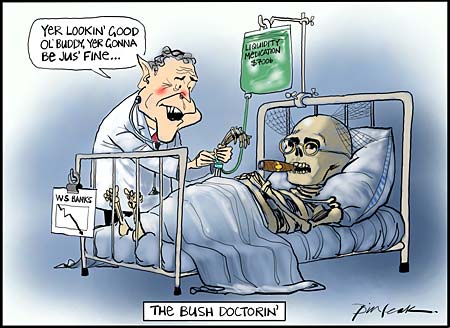

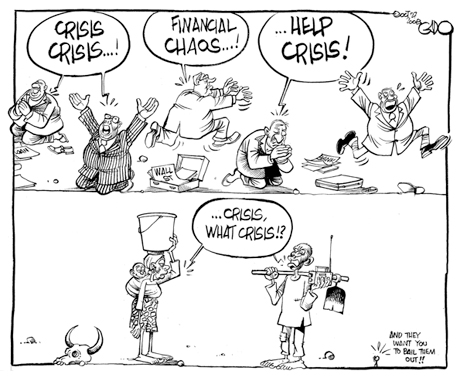

- Bush-doctoring?

- Bush-doctoring?

What is the G20 upto

All G20 members were 'invited' to join another Western Club - the FSF. The Financial Stability Forum, another club, with the same G7 members. Just why does India join these rubber stamp bodies - and lend sanctity to the exploitative agenda of the sponsors. Does the world need another body, with the same Central Bank members, addressing the same monetary issues problems, with the same agenda?

At the sunset city of London, venue of the next G20 conference, Working Group 1, set up to suggest ways to enhance sound regulation and strengthen transparency, with a brief to

"monitor implementation of actions already identified ... make further recommendations to strengthen international standards in the areas of accounting and disclosure, prudential oversight and risk management ... develop policy recommendations to dampen cyclical forces in the financial system and to address issues around the scope and consistency of regulatory regimes.

Co-chaired by Rakesh Mohan, Deputy Governor of the Reserve Bank of India, and Tiff Macklem, Associate Deputy Minister, Canadian Ministry of Finance have readied their initial report - on predictable lines - as per the expected time lines.

Wishful thinking breaks against a brick wall of reality

Sooner rather than later, brothers!

Consistent with 2ndlook's opinion, the Chinese and Russians have been found wanting. Niether have they the respect of the G7, which they so cravenly desire and dont get - and dont value the support and standing that they have in the Third World. Russia has a fond belief that they can float a new currency bloc - with the help of China.

The Russian industrial and corporate systems are on the verge of bankrupty. Russian industry with huge debts payable to Western banks in the next 12 months, have been unable to obtain refinancing of these debts. Russian foreign exchange reserves are down from nearly US$400 billion to US$275 billion.

The Chinese have been reduced to praying for a G20 success - so that their super-prime customer the US starts buying again. Never mind if the US does not pay their purchases. Russia has been threatening to launch a new Third Currency in collaboration with China. In the meantimes, ASEAN has created a emergency fund - like an Asian IMF.

Best of luck, Brother Putin & Tao.

The most dangerous of them all ...

One supra-national currency. That seems like one bad dream. One global currency seems like the ultimate conspiracy theorist. Some 5000-10,000 people will control our lives. Of course, such ideas are injected into the discourse from countries like Russia.

No comments:

Post a Comment