As I noted on this page in December 2007, the presumptive cause of the world-wide decline in long-term rates was the tectonic shift in the early 1990s by much of the developing world from heavy emphasis on central planning to increasingly dynamic, export-led market competition. The result was a surge in growth in China and a large number of other emerging market economies that led to an excess of global intended savings relative to intended capital investment. That ex ante excess of savings propelled global long-term interest rates progressively lower between early 2000 and 2005. (via

Alan Greenspan Says the Federal Reserve Didn't Cause the Housing Bubble - WSJ.com).

I can see the Nobel prize slipping away ...

I can see the Nobel prize slipping away ...

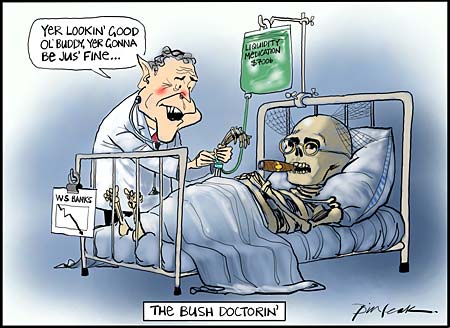

Poor Al! He can see it slipping away from him. What cane he do? Blaming the Asians is good start point. He is not below using Ben Bernanke's rubbish to save his sagging hide.

What does this mean

An Indian economist explained this rather well. Suman Bery, writing for a direction towards Toward a robust globalisation, explained,

In a famous speech exactly four years ago, Fed Chairman Bernanke represented the US as responding passively and benignly to the global “savings glut” which had developed following the East Asian crisis of 1997-98.

Even though most closely associated with Chairman Bernanke, this formulation is widely shared by respectable economists and commentators, such as Martin Wolf of the Financial Times, Professor Richard Portes of the London Business School and the Centre for Economic Policy Research, and Professor Max Corden of the University of Melbourne. The task of recycling these imbalances fell on the sophisticated financial systems of the advanced countries. In the event, for a variety of reasons, even they proved unequal to the burden placed upon them.

Thus Spake Ben Bernanke

Remarks by Governor Ben S. Bernanke, Before the National Economists Club, Washington, D.C. November 21, 2002 (ellipsis mine)

U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press … that allows it to produce as many U.S. dollars as it wishes at essentially no cost. … …the Fed could find other ways of injecting money into the system–for example, by making low-interest-rate loans to banks or cooperating with the fiscal authorities … If we do fall into deflation, however, we can take comfort that the logic of the printing press example must assert itself, and sufficient injections of money will ultimately always reverse a deflation.

A terse anouncement by the Federal Reserve Board said,

“On March 23, 2006, the Board of Governors of the Federal Reserve System will cease publication of the M3 monetary aggregate. The Board will also cease publishing the following components: large-denomination time deposits, repurchase agreements (RPs), and Eurodollars. The Board will continue to publish institutional money market mutual funds as a memorandum item in this release.

On November 10, 2006 Ben Bernanke justified,

“As I have already suggested, the rapid pace of financial innovation in the United States has been an important reason for the instability of the relationships between monetary aggregates and other macroeconomic variables.”

Ben Bernanke has given ample (and more) indications about what he will do. In fact, more than indications, he was brazen enough to say, what exactly he would do! How can the world blame him now?

The Asian ‘savings glut’ was the problem …

The Asian ‘savings glut’ was the problem …

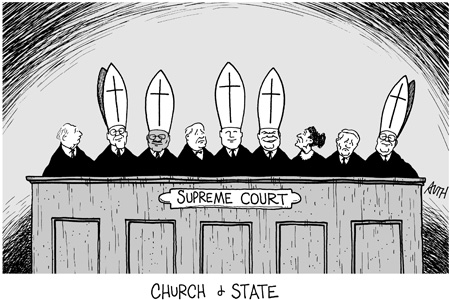

Ben Bernanke joins a long list of Western propagandists, who find ‘specious’ ways to blame others for Western problems. His most recent propaganda gem was to blame Asia for a ‘savings glut.’

a satisfying explanation of the recent upward climb of the U.S. current account deficit requires a global perspective that more fully takes into account events outside the United States. To be more specific, I will argue that over the past decade a combination of diverse forces has created a significant increase in the global supply of saving–a global saving glut–which helps to explain both the increase in the U.S. current account deficit and the relatively low level of long-term real interest rates in the world today.

After Ben Bernanke opened the flood gates of such logic with ‘helicopter drop of dollars’ and ‘printing press technology’, and now the ‘savings glut’ - others such ‘economists’ have rushed in to do another tom-tom dance around this logic.

What’s the word for a red neck economist?

What’s the word for a red neck economist?

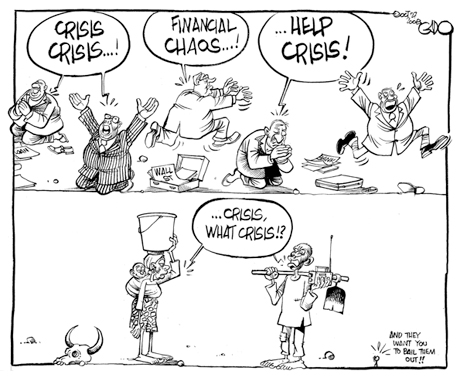

A so called economist, weighed in with two bits, Dani Rodrik: Who killed Wall Street?

…the true culprits lie halfway around the world. High-saving Asian households and dollar-hoarding foreign central banks produced a global savings “glut,” which pushed real interest rates into negative territory, in turn stoking the US housing bubble while sending financiers on ever-riskier ventures with borrowed money. Macroeconomic policymakers could have gotten their act together and acted in time to unwind those large and unsustainable current-account imbalances. Then there would not have been so much liquidity sloshing around waiting for an accident to happen.

The Real Culprits …

The Real Culprits …

Dani Rodrik does not mentioned Ben Bernanke even once. Bernanke’s printing press and helicopter’s are not mentioned even once. The evasion of Federal Reserve on M3 figures are not mentioned even once.

China which has funded the US to the extenet of US$2 trillion is not even mentioned once. Japan which has funded the US to the extent of US$1 trillion is ignored.

Alan Greenspan is mentioned once.

But Asians

countries whose reserves are getting wiped due to dollar depreciation - are instead mentioned as culprits.

Wow. This is a new level in brazen-ness. Keep it up Ben, Al - and not forget you, Dani boy.

Let us see .. what this means …

Lawrence Summers (correctly) described the current global financial system as a “balance of financial terror”. Lawrence Summers could not have been more clear than this. In a speech on March 23, 2004, at the Institute for International Economics, Lawrence Summers described the US strategy. Again on March 24, 2006, at the Reserve Bank of India lecture, he repeated his message.

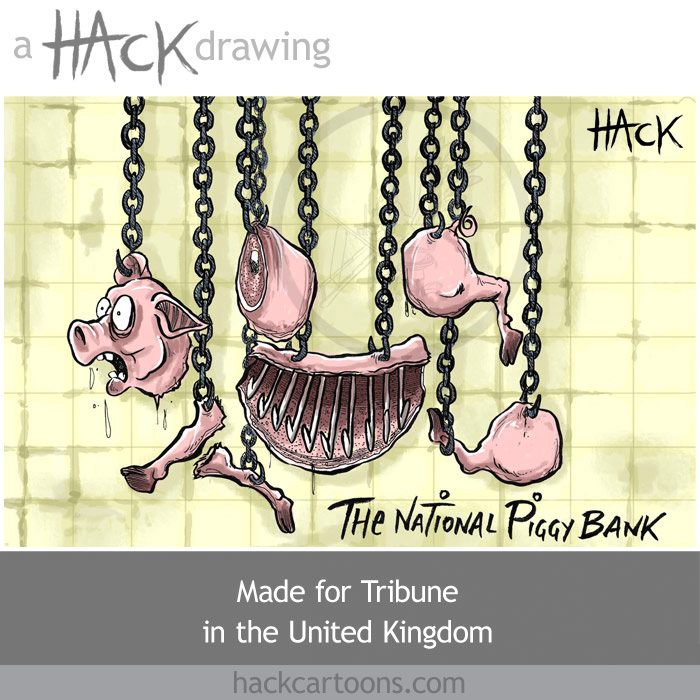

In the last 5 years, more than US$10 trillion were printed and the world is awash with dollars. Where did this money go? How was this used?

“Lendings by US commercial banks in the period 2000 to 2004 soared by altogether USD 1,500bn to USD 6,750bn. In the European Monetary Union lending to the private sector by monetary financial institutions (MFI) climbed from roughly EUR 6,200bn end-1999 to not quite EUR 8,700bn at the end of last year.” - Allianz Report, Dresdner Bank.(Links mine)

The recipients of this largesse, mainly Western banks made (it was whispered) bad loans worth 300-400 billion dollars. Actual figures coming out now are about 20 times as much - much higher.

The loans story does not end there.

These loans were in turn sold and re-sold, then packaged and mortgaged, derived and contrived - finally ballooning into the ‘sub-prime’ crisis. Are these welfare payouts by another name? Who will pay for this “lending”? US Consumers are not repaying their housing loans.

Some one has to!

And that is the root of the problem. The West is trying to make Asians pay!! And people like Ben Bernanke, Alan Greenspan et al are paid hacks to create a logic by which the West will try and make the poor pay.

Nothing less!

All good ideas are foreign ideas ...

All good ideas are foreign ideas ... India's Prime Minister, Finance Minister and Star PM aspirant ...

India's Prime Minister, Finance Minister and Star PM aspirant ...

On Saturday, residents of five communities in cane toad-plagued northern Queensland state will grab their flashlights and fan out into the night to hunt down the hated animals as part of the inaugural "Toad Day Out" celebration. The toads will be brought to collection points the next morning to be weighed and killed, with some of the remains ground into fertilizer for sugarcane farmers at a local waste management plant. (via

On Saturday, residents of five communities in cane toad-plagued northern Queensland state will grab their flashlights and fan out into the night to hunt down the hated animals as part of the inaugural "Toad Day Out" celebration. The toads will be brought to collection points the next morning to be weighed and killed, with some of the remains ground into fertilizer for sugarcane farmers at a local waste management plant. (via